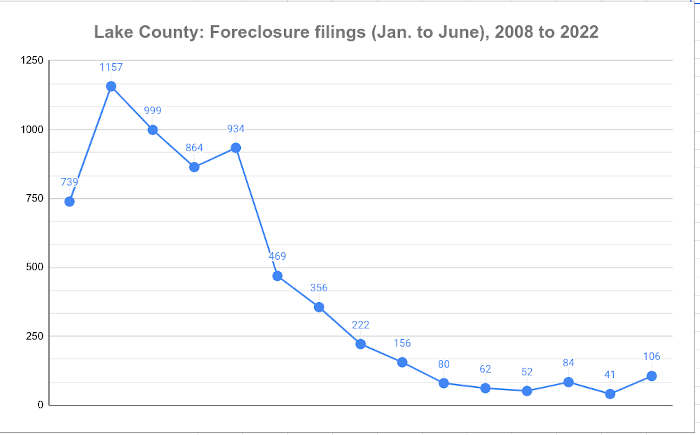

LAKE COUNTY, Calif. — A new report shows that foreclosure filings nationwide for the first half of this year are up significantly compared to last year, which is true in Lake County as well.

ATTOM, a leading curator of real estate data nationwide for land and property data, released its Midyear 2022 U.S. Foreclosure Market Report, which shows there were a total of 164,581 U.S. properties with foreclosure filings — default notices, scheduled auctions or bank repossessions — in the first six months of 2022.

That figure is up 153% from the same time period a year ago but down just one% from the same time period two years ago.

In Lake County, there were 106 foreclosure filings in the first half of this year, compared to 41 in the same period last year, a 158% increase.

In Lake’s neighboring counties, the trend is holding true. Glenn has 11, a 450% increase; Mendocino, 66, 135% increase; Napa, 57, 119%; Sonoma, 220, 92%; and Yolo, 72, 300%. Colusa County reported having no such filings in 2022, and only two in 2021.

“Foreclosure activity across the United States continued its slow, steady climb back to pre-pandemic levels in the first half of 2022,” said Rick Sharga, executive vice president of market intelligence at ATTOM. “While overall foreclosure activity is still running significantly below historic averages, the dramatic increase in foreclosure starts suggests that we may be back to normal levels by sometime in early 2023.”

Bucking the national trend with decreasing foreclosure activity compared to a year ago in the nation’s most populated metros during the first half of 2022, where only seven of the 223 metro areas analyzed.

Those metros included Lake Havasu, Arizona (down 47%); Eugene, Oregon (down 27%); Springfield, Illinois (down 19%); Shreveport, Louisiana (down 9%); and Brownsville, Texas (down 8%).

Nationwide 0.12% of all housing units (one in every 854) had a foreclosure filing in the first half of 2022.

States with the highest foreclosure rates in the first half of 2022 were Illinois (0.26% of housing units with a foreclosure filing); New Jersey (0.24%); Ohio (0.21%); Delaware (0.20%); and South Carolina (0.19%).

Other states with first-half foreclosure rates among the 10 highest nationwide were Florida (0.18%); Nevada (0.18%); Indiana (0.16%); Georgia (0.13%); and Michigan (0.13%t).

Among 223 metropolitan statistical areas with a population of at least 200,000, those with the highest foreclosure rates in the first half of 2022 were Cleveland, Ohio (0.40% of housing units with foreclosure filings); Atlantic City, New Jersey (0.33%); Jacksonville, North Carolina (0.31%); Chicago, Illinois (0.30%); and Columbia, South Carolina (0.30%).

Other metro areas with foreclosure rates ranking among the top 10 highest in the first half of 2022 were Rockford, Illinois (0.30% of housing units with a foreclosure filing); Lakeland, Florida (0.27%); Akron, Ohio (0.24%); Fayetteville, North Carolina (0.24%); and Trenton, New Jersey (0.23%).

Foreclosure starts up 219% from last year

A total of 117,383 U.S. properties started the foreclosure process in the first six months of 2022, up 219% from the first half of last year and up 19% from the first half of 2020.

States that saw the greatest number of foreclosures starts in the first half of 2022 included, California (12,805 foreclosure starts); Florida (11,448 foreclosure starts); Tennessee (10,970 foreclosure starts); Illinois (8,411 foreclosure starts); and Ohio (6,987 foreclosure starts).

“It’s important to note that many of the foreclosure starts we’re seeing today – in fact, much of the overall foreclosure activity we’re seeing right now – is on loans that were either already in foreclosure or were more than 120 days delinquent prior to the pandemic,” Sharga added. “Many of these loans were protected by the government’s foreclosure moratorium, or they would have already been foreclosed on two years ago. There’s very little delinquency or default activity that’s truly new in the numbers we’re tracking.”

Bank repossessions climb in first half of 2022

Lenders foreclosed, or REOs, on a total of 20,750 U.S. properties in the first six months of 2022, up 30% from the last half of 2021 and up 113% from the first half of 2020.

States that posted the greatest number of REOs in the first half of 2022 included, Illinois (2,434 REOs); Michigan (2,259 REOs); Pennsylvania (1,290 REOs); California (1,043 REOs); and Florida (1,041 REOs).

There were a total of 90,139 U.S. properties with foreclosure filings in Q2 2022, up 15% from the previous quarter and up 165% from a year ago.

The national foreclosure activity total in Q2 2022 was 68% below the pre-recession average of 278,912 per quarter from Q1 2006 to Q3 2007, making Q2 2022 the 23rd consecutive quarter with foreclosure activity below the pre-recession average.

Second quarter foreclosure activity was below pre-recession averages in 177 out 223 (79%) metropolitan statistical areas with a population of at least 200,000 and sufficient historical foreclosure data, including New York, Los Angeles, Chicago, Dallas, Houston, Miami, Atlanta, San Francisco, Riverside-San Bernardino, Phoenix and Detroit.

Metro areas with second quarter foreclosure activity above pre-recession averages included Honolulu, Richmond, Virginia-Beach, Albany, and Montgomery.

Properties foreclosed in the second quarter of 2022 took an average of 948 days from the first public foreclosure notice to complete the foreclosure process, up from 917 days in the previous quarter and up from 922 days in the second quarter of 2021.

How to resolve AdBlock issue?

How to resolve AdBlock issue?