Many medical organizations have been recommending lung cancer screening for decades for those at high risk of developing the disease.

But in 2022, less than 6% of people in the U.S. eligible for screening actually got screened. Compared with other common cancer screenings, lung cancer screening rates fall terribly behind. For comparison, the screening rate in 2021 for colon cancer was 72%, and the rate for breast cancer was 76%. Why are lung cancer screening rates so poor?

I am a pulmonologist who specializes in screening and diagnosing lung cancer. In my research to improve early detection of lung cancer, I’ve found that numerous complex barriers hinder the widespread adoption of lung cancer screening.

Basics of lung cancer screening

Lung cancer is the leading cause of cancer-related death in the world. But early detection can significantly improve outcomes.

Survival rates for early stage lung cancer are nearly seven times higher than lung cancer that has spread in the body. Between 2015 and 2019, survival rates for lung cancer have improved by 22%, in part because of an increase in earlier diagnosis.

Most patients with early-stage lung cancer, however, have no symptoms and aren’t diagnosed until they reach more advanced stages that are harder to treat, underlining the need for effective lung cancer screening.

The U.S. Preventive Services Task Force recommends lung cancer screening for people 50-80 years old, people who currently smoke or previously smoked but quit within the past 15 years, and people who smoked at least 20 pack-years. Pack-years is an estimate of cigarette exposure in a person’s lifetime, calculated by multiplying the total number of years someone has smoked by the average number of packs smoked per day. For example, if someone smoked half a pack per day for 40 years, they would have smoked for 20 pack-years.

Low-dose CT scan for lung cancer

One of the primary barriers to lung cancer screening is lack of public awareness and understanding. Many people are unaware they qualify for lung cancer screening or have misconceptions around what to expect from the screening process.

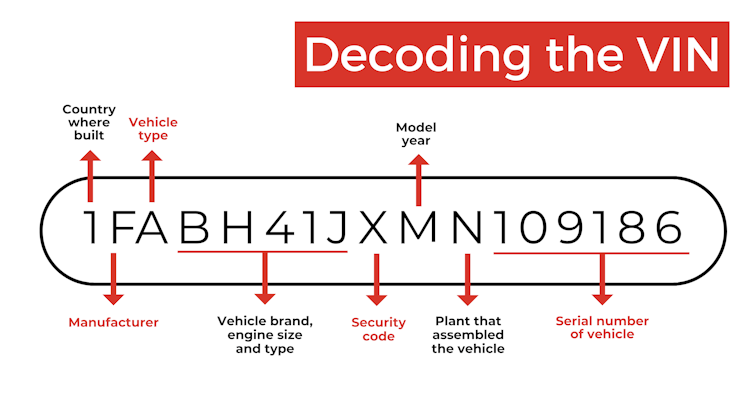

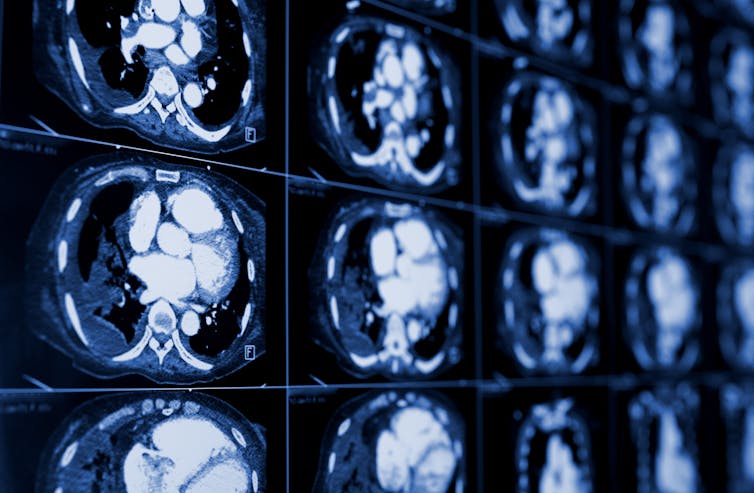

Lung cancer screening involves a yearly low-dose computed tomography, or CT, scan, a diagnostic imaging tool that uses X-rays to create detailed cross sections of the inside of the body. Screening 250 patients can prevent one lung cancer death. In comparison, 645 people screened with a mammogram can prevent one breast cancer death.

Some people have reservations surrounding the scan itself because of radiation exposure. The radiation from a low-dose CT scan, however, is about 1.4 millisieverts – the scientific unit used to measure ionizing radiation – which is less than the 3 to 5 millisieverts of background radiation a person may be exposed to in a given year on average while living on Earth.

The whole process takes only a few minutes and does not require any needles, medications or infusions. During the scan, the patient lies on the scanner’s sliding table and raises their arms above their head. The technologist may ask them to hold their breath for 5 to 10 seconds as the table passes through the scanner.

A radiologist summarizes the results of the test for their doctor in a report. If the result is negative for findings in the lungs, the patient would return in one year for another scan. If the result is positive, it usually means the radiologist saw a lung nodule, or a spot on the lung. Not all lung nodules are cancer, and patients may require additional imaging or a biopsy to confirm.

Disparities in lung cancer screening

Public health campaigns and education initiatives work to engage the public and increase awareness of the availability and benefit of lung cancer screening. However, these efforts have been less effective in some of the communities most at risk for developing lung cancer.

African American men have the highest rates of developing and dying from lung cancer compared with other groups, even at younger ages and among those with less smoking history. The tobacco industry has explicitly targeted the Black community with pervasive marketing tactics in predominantly Black neighborhoods and stores. Since the 1970s, the tobacco industry has aggressively marketed menthol cigarettes to African Americans using tailored messaging and imagery. This compounds and exacerbates the socioeconomic disparities in health care and cancer care already seen in these underserved and underrepresented communities.

Rural communities face geographic barriers to lung cancer screening. About 80.5 million Americans live in counties with high rates of lung cancer and poor access to a quality screening center. Many of these counties are clustered in the Appalachian and southeastern regions of the U.S. where smoking rates are highest. Over 60% of people living in rural areas who are eligible for lung cancer screening have to travel over 20 miles to a screening facility.

Lung cancer screening may also be costly. While most private insurances and Medicare cover the cost of lung cancer screening, Medicaid policies vary state by state and may not cover the cost of lung cancer screening. In addition, while some plans may cover the initial low-dose CT scan, they might not cover follow-up testing, procedures and treatment. Supplementary costs such as transportation, time off from work, child care and other logistical issues can also add up to create additional socioeconomic barriers to screening.

Communities that are under- or uninsured are at the highest risk of developing lung cancer. They often lack access to primary care providers, let alone specialists who can facilitate screening.

Erasing smoking stigma

Because lung cancer is linked to smoking, stigma plays a significant role in preventing many people eligible for screening from pursuing it. Many people eligible for lung cancer screening fear being blamed for their previous or current tobacco use.

Stigma also discourages patients from discussing lung cancer screening with their health care providers or community. Clinicians can partner with patients and communities to destigmatize lung cancer and tobacco dependence, extricating the disease from blame. Framing screening as a proactive measure to help those at risk of developing lung cancer and as a collaboration with those who need help quitting smoking can empower people to actively engage in screening rather than dreading or avoiding it.

Fear is another barrier. Many people believe that a lung cancer diagnosis is a death sentence. When diagnosed early, however, doctors treat lung cancer with an intention to cure. Additionally, advances in lung cancer treatment over the past 10-15 years have led to remarkable improvements in survival for all stages of the disease. Reassurance and education around next steps and paths to treatment at the time of screening help diffuse some of the distress surrounding lung cancer.

Public health researchers are exploring how to minimize the significant and complex barriers to lung cancer screening for those who need it most.![]()

Nina Thomas, Assistant Professor of Pulmonary Sciences and Critical Care, University of Colorado Anschutz Medical Campus

This article is republished from The Conversation under a Creative Commons license. Read the original article.

How to resolve AdBlock issue?

How to resolve AdBlock issue?